kansas dmv sales tax calculator

11 years old or older. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase.

Missouri Vehicle Registration Of New Used Vehicles Faq

There are also local taxes up to.

. 24 flat rate there is no weight fee. Claimants have until April 15 2023 to file an application for this financial assistance. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

Maximum Possible Sales Tax. In addition the Department has established a dedicated phone line specifically for the COVID-19 Retail. Shawnee County is the third largest county in the state of Kansas and is the home of the capital city Topeka.

Effective July 1 2002 if the vehicle is purchased in a taxing jurisdiction that has a lower. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The sales tax in Sedgwick County is 75 percent.

Check prior accidents and damage. How to Calculate Kansas Sales Tax on a Car To calculate the sales tax on your vehicle find the total. Wed love the opportunity to.

Kansas Vehicle Property Tax Check - Estimates Only. 30 plus 050 per 100 lbs. Kansas State Sales Tax.

The county the vehicle is registered in. Maximum Local Sales Tax. Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year.

Kansas has a 65 statewide sales tax rate but also. In addition to taxes car. If you are unsure call any local car dealership and ask for the tax rate.

To calculate sales tax visit Kansas Department of Revenue Sales Tax Calculator. 1981 and newer models. DO NOT push any buttons and you will get an.

The following page will only calculate personal property taxes. For more details on the age weight and size calculations for RV and motorhome property tax figures you can contact your local county treasurers office. Motor Vehicle Fees And Payment Options Johnson County Kansas You can do this on your own or use an online tax calculator.

How to calculate kansas sales tax on a car. Once you have the tax. When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including.

Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle. Vehicle Property Tax Estimator. How to Calculate Kansas Sales Tax on a Car.

Multiply the vehicle price. Use the Kansas Department of Revenue Vehicle Property Tax Calculator to estimate vehicle property. Kansas collects a 73 to 8775 state.

To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. Learn more about Shawnee County in the Visitors CenterFind out about local. The sales tax in Sedgwick County is 75 percent.

A sales tax receipt is required if you have purchased the vehicle from a Kansas motor vehicle dealer. Dealership employees are more in tune to tax rates than most government officials. Average Local State Sales Tax.

You pay property tax when you initially title and register a vehicle and each year when you renew your vehicle tags and registration. There are also local taxes up to 1 which will vary depending on region. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles.

The kansas sales tax rate is currently. Interactive Tax Map Unlimited Use. Motor vehicle trailer atv and watercraft tax calculator.

Vehicle property tax is due annually. 50 plus 070 per 100 lbs. 6 to 10 years old.

Directions for step-by-step driving instructions to Northtowne Lincoln Kansas City or you can always give us a call. The calculator will show you the total sales tax amount as well. The minimum is 65.

There are also local taxes up to 1 which will vary depending on region. How kansas motor vehicle dealers should charge sales tax on vehicle sales. Vehicles less than 4500 pounds.

Tax Sale 351 Unified Government Of Wyandotte County And Kansas City

Why Trade In Your Vehicle Midwest Toyota

Treasury Unified Government Of Wyandotte County And Kansas City

Property Taxes Chanute Ks Official Website

Kansas Vehicle Sales Tax Fees Find The Best Car Price

Kansas Department Of Revenue Division Of Vehicles Vehicle Tags Titles And Registration

Motor Vehicle Fees And Payment Options Johnson County Kansas

Register A Newly Purchased Vehicle Unified Government Of Wyandotte County And Kansas City

Car Sales Tax In Kansas Getjerry Com

Wilson County Kansas Motor Vehicle

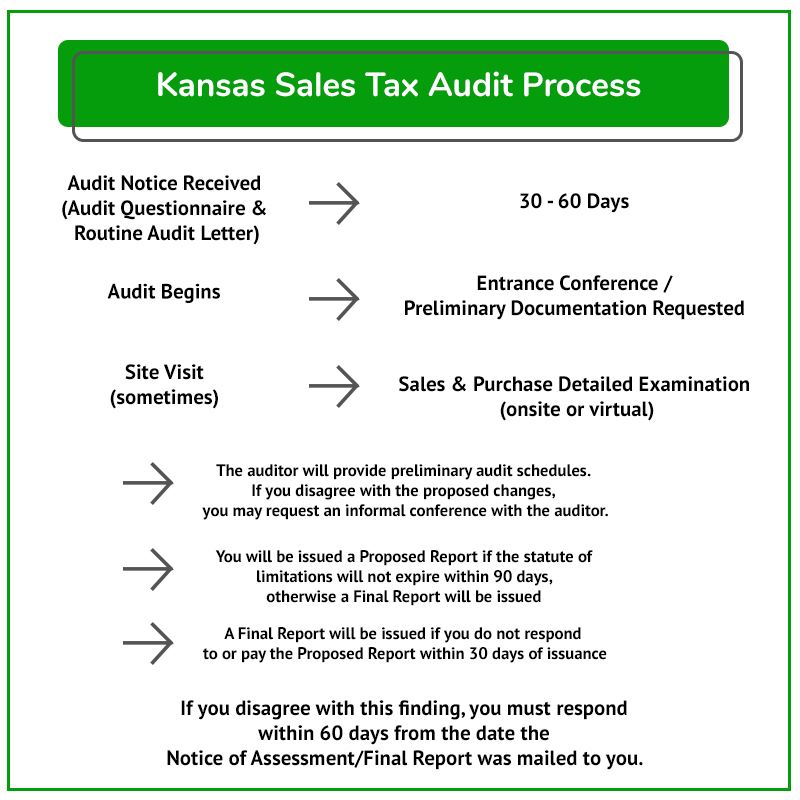

How To File And Pay Sales Tax In Kansas Taxvalet

Treasurer Douglas County Kansas

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

Kansas Department Of Revenue Home Page

Kansas Vehicle Sales Tax Fees Find The Best Car Price

Your Guide To The United States Sales Tax Calculator Tax Relief Center

Kansas Sales Tax Guide For Businesses